You’ve Decided That Working Independently is the Ideal Job Description for You Because...

“You Want to Make Sure This is the Best Opportunity to Secure a Better Life for Your Family in Germany.”

In the following sections, you will learn about:

- The Benefits of Working with UberEats

- The Exact Details You Need to Get Started NOW

- How to Work and Earn MORE, Step by Step

- A Few Secrets to Shorten Your Path to Success

And if you’re still wondering whether this job is right for you, I want to make it crystal clear:

- It doesn’t matter if you have no prior experience in deliveries or entrepreneurship.

- It doesn’t matter if you don’t know where to start or how to increase your income… (this job is stable, easy, and flexible, specifically designed to help you EARN more than you do now).

- It doesn’t matter if you already have a job with a strict schedule, here you have complete flexibility to work whenever you want… ( I’ll show you a strategy to make €936 in your free time).

- And it definitely DOESN’T MATTER if you’re new in Germany, don’t speak the language well, don’t understand the legal system, or don’t know how to start a business…(I will help you with all the details if you keep reading).

Die Arbeit bei Orkino bietet Ihnen einen äußerst lukrativen, flexiblen und stabilen Job, der Ihr Leben verändern kann, so wie es bei über 700 Kurieren der Fall war, mit denen ich im Laufe der Jahre

Delivering with UberEats is More Than a Job, It's an Opportunity to Grow.

Because👇

You Earn BETTER than 99% of part-time, full-time or mini-jobs.

The UberEats payment system rewards you for your efficiency because you earn based on orders, not per hour in most cities.

Here are Uber’s rates for each delivered order:

- €1,70 when you pick up the order.

- €0,84 per kilometer traveled from the restaurant to the customer.

- €1,20 când finalizezi comanda.

- A coefficient of 1.1-2.0 that increases your earnings depending on the city.

- Tips. *VAT is included in each rate, except for tips.

Unlike a traditional job, here you also:

Receive your earnings every week directly in your bank account (Revolut, Wise or any German bank).

Have the UNIQUE opportunity to grow financially and not be limited to a fixed monthly wage.

You Win with an Opportunity Tailored to Your Needs!

It doesn’t matter if you already have a job but want to earn more, or if you decide to focus entirely on UberEats, you have complete flexibility to earn according to your needs.

Imagine getting paid €1000 a month to watch movies in your free time, after a tiring shift at your main job.

Uber has thought about this too, so only in the coming months do you have a guaranteed minimum of €12 + VAT per hour in newly launched cities.

This means you could watch movies in your car for 3 hours a day, 6 days a week, while being connected to the UberDriver app and earn nearly €1000, even if you don’t receive any orders. (26 days x 3h/day x €12/h = €936, without lifting a finger).

But you must commit to accepting and delivering every order, and in the new cities, you typically receive one order per hour on average, earning around €10-20 and working about 15-20 minutes in an hour.

So even if you already have a full-time job and are looking for something to supplement your monthly earnings…

This opportunity can boost your income by at least a few hundred euros per WEEK if you work about 50% of the time and spend the rest watching movies in your car.

However, the offer isn’t available for long because newly launched cities “mature” in a few months and the number of orders increases, and Uber will stop the guaranteed minimum of €12/h.

Once cities reach maturity, like Munich, Berlin, Hamburg, or Frankfurt, it’s much more beneficial to be your own boss and focus solely on entrepreneurship.

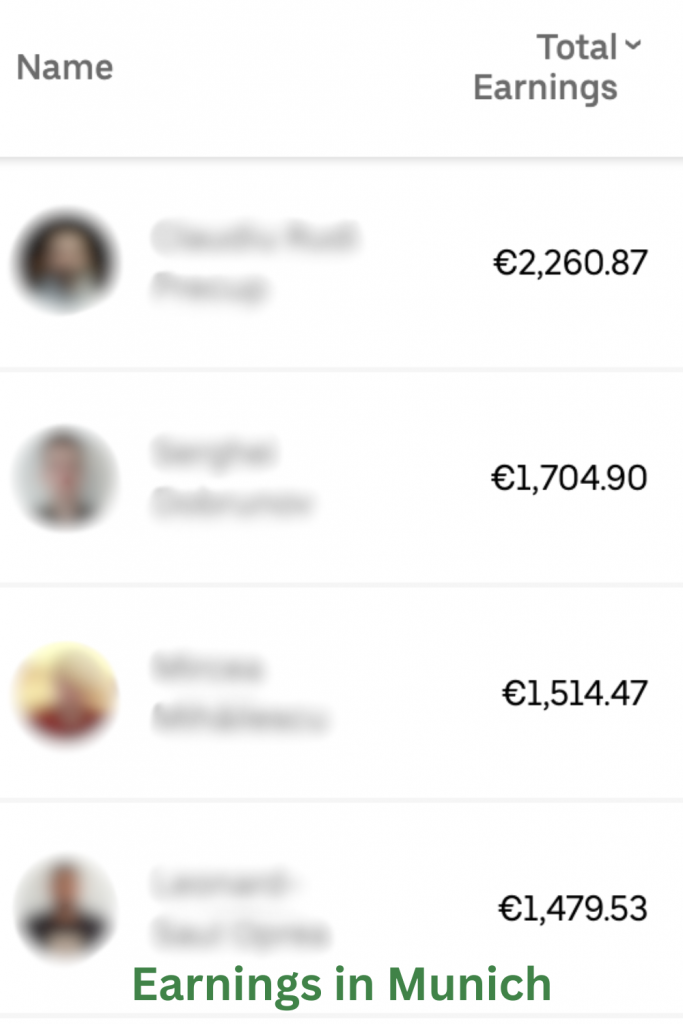

Because you always have orders, so you always have work, and it’s normal to earn €1000-€1500 per week as you can see in these pictures.

It’s easy even for PREGNANT WOMEN?

Among the couriers, there’s a joke that even pregnant women can easily deliver with UberEats because:

- It’s a Simple and Stable Job: Deliver food, medicine, and groceries from point A to point B, with driving being the most challenging part.

- You have a Reliable App: Manage orders, track earnings, and get assistance with just a few clicks in the UberDriver app.

- Total Freedom and Flexibility: Control your earnings, schedule, and work ethic; work whenever and however you want.

Delivering orders around the city sounds more like a relaxing hobby than a job where you struggle to make money.

But there are additional benefits that come with independent work and go beyond the limits of typical delivery jobs like:

If you want to go on vacation for a few weeks, you can simply click here and complete our form to let us know how long you’ll be away.

If you want to check your earnings for the past week, click here to download all your invoices from our app.

Or if you’d like, you can change the bank account where you receive your weekly payments… just fill out our bank account change form here.

You Integrate Easily Into our System.

Nachdem Sie das Flottenregistrierungsformular ausgefüllt haben, ruft mein Team Sie an und erklärt Ihnen jedes Detail, sodass Sie sich keine Sorgen machen müssen, wenn etwas unklar ist.

Wir können Ihnen bei allen Herausforderungen helfen, wenn Sie unserem Support-Team unter +491796171099 eine Nachricht auf WhatsApp hinterlassen.

Wenn es zu einem Missverständnis mit einem Restaurantmitarbeiter kommt, Sie zu lange auf eine Bestellung warten müssen oder andere Probleme auftreten, die Ihre Arbeit stören, können Sie hier klicken, um ein Formular für Problemrestaurants auszufüllen . Ich werde dann dafür sorgen, dass Uber über Ihre Probleme informiert wird.

Wenn Sie nicht wissen, wie Sie Ihr erstes Unternehmen gründen oder wohin Sie uns Ihre Unterlagen schicken sollen …

Oder wenn Sie ein Problem haben, dessen Behebung länger als 10 Minuten dauert …

Kontaktieren Sie unseren Flottensupport per WhatsApp unter +491796171099 und wir finden für jedes Ihrer Probleme eine Lösung.

All You Have To Do Is Say “MAYBE” And You Can Apply Now...For FREE!

How to Become an UberEats Courier: A Step-by-Step Guide

Now that I’ve given you all the details about this UNIQUE opportunity…

Here Are the Steps to Become a Courier with UberEats.

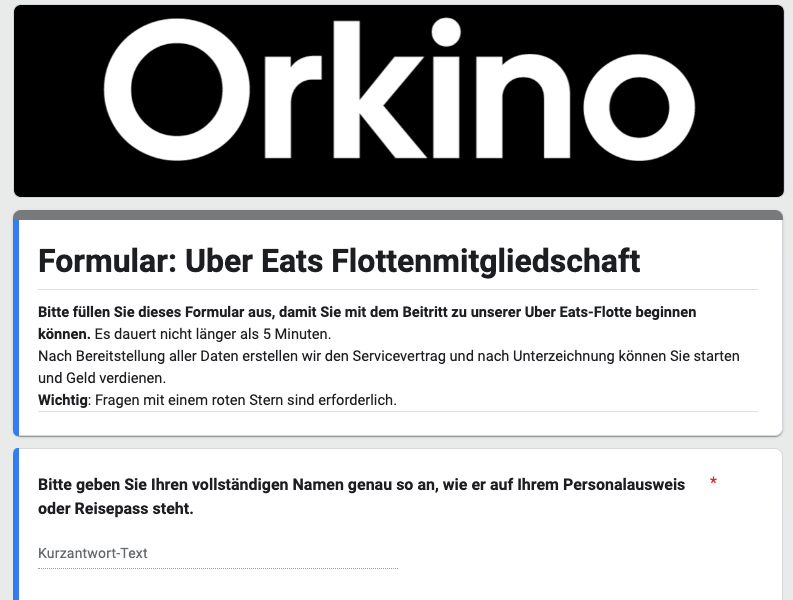

1. Complete Our Registration Form.

After you complete the registration form, our support team will contact you and provide all the details about the job.

2. Download the UberDriver App and Complete the Steps.

Click here to install the UberDriver app from Google Play or here from the App Store.

After you accept the Uber Terms and Conditions in the app, you essentially sign the contract as you would with a traditional job.

Create an account and complete a few simple steps in the app.

Eventually, you will need a delivery bag from Uber to carry orders. Click here to purchase your own UberEats courier bag.

We may have a delivery bag in your region, which you can get for FREE if you cover the shipping price.

Contact our support on WhatsApp at +4917641549702 to see if you can receive a FREE delivery bag or if you encounter any difficulties completing the steps in the app.

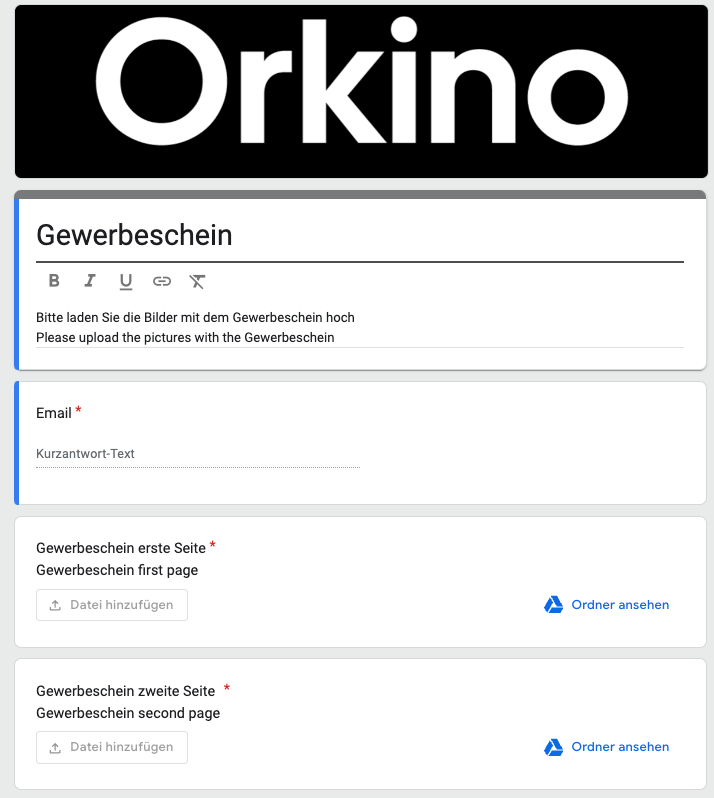

3. Upload Your Company’s Documents (Gewerbeschein) or Apply to Open a Company (Gewerbe).

To fully enjoy the benefits of entrepreneurship, you need to learn how to start and manage your company.

In most cases, I recommend starting as sole-proprietorship (Einzelunternehmen), but we accept any legal form of company like a GmbH or UG.

Once you have the form signed and stamped by the institution where you applied (Gewerbeschein), you can send us 2 photos via a form.

However, if you’re unsure of the process to open and run a company or Gewerbe…

Then it’s completely normal to be skeptical because it implies a level of responsibility you might be uncertain of…

That’s why I summed up all of the info you need to start your company TODAY and earn more tomorrow.

Click here to learn everything you need about starting your business, the German law, taxes and more.

4. Contact us to activate your account.

Kontaktieren Sie uns per WhatsApp unter +491796171099 , um nach Abschluss aller Schritte und Einreichen Ihrer Unterlagen Ihr Konto zur Aktivierung zu senden.

Der Uber-Manager aktiviert Ihr Konto basierend auf der Nachfrage nach Kurierdiensten in Ihrer Stadt.

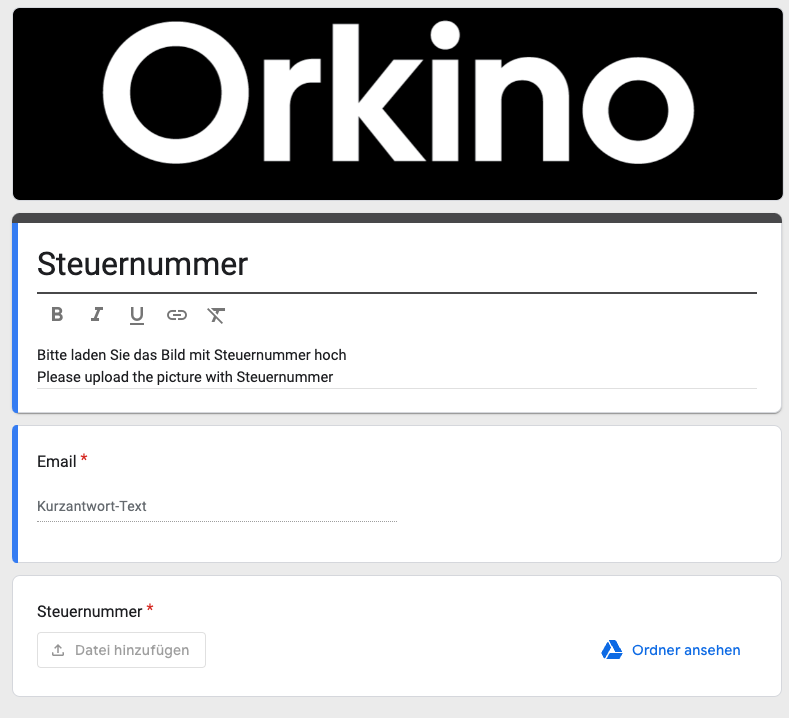

5. Send us your company number (Steuernummer) after you start working.

You don’t need a Steuernummer to start working, but it’s a good idea to apply for one at the Finanzamt once you begin earning from your business because…

German law requires us to have your company number (Steuernummer) to pay you more than €5000 in total.

If you have a Gewerbe and its Steuernummer, go to the Documents section in the app to upload the document and potentially receive a VAT refund.

It's likely that you still have some questions, such as:

- How much can I earn EXACTLY?

- Why do I need to work with a company for a courier job

- How do I pay taxes on my Gewerbe?

- And many others.

To Be Crystal Clear...

I Want To Do Everything In My Power To Make Sure You Are Satisfied With My Fleet's Services, But Also...

"Become Your Own Boss and Earn MORE to Live a Better Life in Germany!"

And to help you open a Gewerbe and start EARNING as quickly as possible, I will answer the Frequently Asked Questions to clear up any confusion.

Frequenly Asked Questions

Once you inform the fleet operator that you have submitted your Gewerbe, your account will be placed on the activation list for your chosen city. Activation depends on courier demand and the Uber manager's schedule.

For example, in high-demand areas like when UberEats launched in Pforzheim, accounts were activated in less than a day. However, timing varies by city, so there is no exact start date.

If you're unsure, ask our operators about the current demand in your area for an estimate, or click here to consult our city map to see the best opportunities.

To work with UberEats in Germany, you must have a company (Transport up to 3.5 tons or Food and Beverage Delivery Services) from your first day. Since the work is independent, you need a company in your name. A sole proprietorship (Einzelunternehmen) is sufficient.

Uber works with fleets (delivery service partners) who verify your documents and facilitate the connection with Uber managers. To start working, we need to know you have a company or at least intend to apply for one.

You can open your own Einzelunternehmen by completing a form (Gewerbeanmeldung) and submitting it at the local town hall (Rathaus) or the Gewerbeamt. The usual cost for opening and closing a company is between 15 and 60 euros.

For a husband and wife working under the same Gewerbe:

To provide clarification on a husband and wife working under the same Gewerbe I will quote from: https://www.manager-magazin.de/finanzen/artikel/a-270568.html:

“Each spouse has the right to work for remuneration. Section 1356 of the Civil Code (BGB) clearly states in paragraph 2: 'Both spouses have the right to engage in gainful employment. When choosing and pursuing a job, they must duly consider the interests of the other spouse and the family.'”

This means that nothing stands in the way of employing the spouse. However, if the partners live in a community of property, it must first be checked whether the business is part of the spouses' 'joint property.'

In these conditions, no employment contract can be concluded. In this case, it is a partnership relationship. Salaries will then be paid as a share of the profit.

Even if the spouse is not a co-owner of the business, they can be employed as an assisting partner based on a partnership agreement.

So even if the wife cannot be employed in your sole proprietorship, she can work with you in an Einzelunternehmen.

For groups of 2-3 people, a GbR (civil-law partnership) works, where the profit is divided at the end of the year, and one of them can declare more profit to protect the others from declaring too much profit in various places.

For example, one of the employees in a GbR also works at Lieferando and, in reality, exceeds the profit limit, so they must also pay a difference in health insurance. To avoid complications, another person in the same GbR declares a higher profit but ensures that the gross profit is less than the gross salary for the whole year.

We can teach you many aspects of tax minimization, but this is just an educational aspect.

In your current situation, we recommend writing down many questions in a notebook and consulting an accountant to see what applies to your case.

First of all, I am not a certified accountant in Germany, but after paying a significant amount of taxes, I can share my personal experience to give you some important details about taxes in Germany and why you shouldn't worry too much about them.

It's normal to be concerned about taxes at first if you don't know how much, how, or when to pay them, because you don't want to have issues with the German authorities over a small mistake.

In any case, you can't avoid taxes in any way, whether you are an employee or an entrepreneur, so it's better to learn about the tax system than to fear it.

Unless you are an accountant, your goal should be to focus on earning money to live a better life in Germany, not to worry about taxes.

There are a few simple tricks that will help you avoid any tax issues:

· Be calculated and always keep a reserve of money to pay taxes.

· Know the basics of the tax system so you can earn more and save at the same time. (Read on to see which taxes you need to pay based on your situation).

· If you have a question or concern, consult an accountant if you need help.

I had an example where the difference in taxes between two employees, both earning €20,000 a year, was over €3,000. So, if you know how to navigate the unclear world of accounting, you can save more than €3,000 a year.

Next, I will provide you with the basic information you need about taxes, whether you already have a full-time job and want to work part-time for UberEats or you want to work full-time for UberEats without another job.

When you work as a side job (nebenjob) with Uber and already have a part-time (teilzeit) or full-time job:

The only mandatory tax for those who work with UberEats in addition to a full-time job is the income tax (Einkommensteuer).

When you have income as a sole proprietor (Einzelunternehmen), you need to file a family tax return (Steuererklärung): Gross salaries + gross profit from the sole proprietorship + other income - prepaid tax through tax class (Steuerklasse) - family deductions determine the payment difference.

Here are examples of deductible expenses:

· Car expenses: There are three ways in Germany to deduct car expenses.

· Phone expenses: like purchasing phones, subscriptions, or prepaid card top-ups.

· Work equipment: such as work bags, jackets, shoes, etc.

· Meals at restaurants while acquiring new clients.

· Daily Allowance: €14 per day for any day you were away from home for more than 8 hours.

Here are examples of family expenses:

· Kindergarten and mandatory education expenses (hobbies are not included).

· Donations: to churches or other associations.

· Volunteer work: If you are a volunteer for a non-governmental organization (NGO), you receive a tax deduction (Freibetrag).

· Medical expenses: including travel to the doctor, are deductible at €0.30 per kilometer.

VAT

Value Added Tax (Mehrwertsteuer or Umsatzsteuer) is 19% for most services and products, including food delivery.

If you have a Kleinunternehmen and make up to €22,000 per year, you can choose whether to pay VAT or not.

I recommend being a VAT payer, even if you work part-time and have another job because:

When you are a VAT payer, it doesn't matter how much VAT you collect, but how much you consume. For example, in one year you collect €10,000 VAT but consume €6,000. The difference of €4,000 goes to the Finance office.

Another example: In one year you collect €1,000 VAT but purchase a car with €1,500 VAT and make additional purchases with €300 VAT. Then you will receive the difference between €1,800 and €1,000, which is €800, from the Finance office.

In principle, if you plan on making large purchases, such as a car, you can buy it 19% cheaper. To take advantage of this benefit, you need to register as a VAT payer by obtaining your company number (Steuernummer) from the Finanzamt.

Whether you are a VAT payer or not, we can only pay you up to €5,000 without a Steuernummer, so you should obtain this document as soon as you receive your Gewerbe number and upload it in the app.

What benefits do you have when working with a Gewerbe and a full-time job?

· You can file an appeal with BG Verkehr to be exempt from paying the insurance of around €70 per month.

· As long as your gross salary is higher than your gross profit, you are exempt from paying health insurance.

· As long as the gross profit, i.e., revenues minus expenses, is under €24,500, you do not pay Gewerbesteuer for Einzelunternehmen and other simpler legal forms.

· A pension is not mandatory in the first few years, but I recommend it.

There are more benefits and requirements for working part-time at your own company that you can learn about by consulting with an accountant.

Or you can search for more information about benefits and requirements at Deutsche Rentenversicherung.

When you work full-time on your Gewerbe:

The same taxes as part-time, but here you will pay:

· Workplace accident insurance with BG Verkehr of around €70 per month.

· Income tax (Einkommensteuer).

· Pension contributions.

· You need to pay health insurance, but you can choose between public and private insurance providers.

· As long as your gross profit exceeds €24,500 per year, you will pay Gewerbesteuer. Click here to calculate it.

The contributions you make annually are less than what your employer would normally pay for you if you were an employee.

So, it is worth studying the German tax system and understanding what and why you need to pay to the state, as it can save you a considerable amount of money.

The answer to this question is that it depends on many variables, but YOU are the most important one…

You can earn anywhere from €12 up to our fleet record of €2260.87 per week.

To get an accurate idea of your weekly earnings, consider the city you work in:

· If it is a city where Uber has recently expanded, it means there aren’t that many orders yet, but there is a guaranteed minimum of €12/h + VAT + tips.

This could be an excellent alternative to a part-time or mini-job to supplement the income from your main job.

If you work 3 hours a day, 6 days a week at €12/h, you earn €936 monthly if you don't deliver any orders but just relax in your car after your main job. Add to this number the earnings from the orders made, and you can make a few hundred euros a week if you “work” this way.

· In a big city with many orders, you can focus completely on Uber because you have no limit to your earnings.

You can deliver 3 different orders at the same time, work around 8 hours a day, and consistently earn over €1000 per week.

Just like over 25 couriers in our fleet who have earned over €1000 weekly this year using THIS SECRET to get more orders in big cities (but it also works in smaller ones to some extent).

If you work efficiently and quickly, Uber will give you more orders, thus increasing your chance to boost your income.

The Uber system assigns orders to couriers with the most experience (total number of orders delivered) and the best rating according to Uber standards.

UberEats standards are as follows:

· At least 95% order acceptance rate.

· At least 95% order completion rate, so do not cancel more than 5% of received orders.

· Positive client feedback of over 95%.

· An average time of under 10 minutes to the restaurant.

· An average time of under 30 minutes from the restaurant to the customer.

If you meet these standards and increase your total number of deliveries day by day, not only will UberEats see you as a VALUABLE courier and not block your account in case of misunderstandings…

But it will also give you more and more orders until you don’t know which ones to accept.

UberEats fleets charge a commission from the weekly earnings of each courier.

And I’m sure you can’t name another fleet on the market that charges a lower commission than us.

In my fleet, the percentage can be AS LOW AS 5% of your weekly income.

The fleet commission varies based on your weekly income after you start working.

Here is a chart to see the fleet commission based on your weekly earnings:

Over 700 partners who trusted Orkino.de in the past 2 years have said “MAYBE”.

My experience in Germany taught me that when you’re not sure about an opportunity, just say ‚MAYBE‘.

This way, you don’t make a promise, but also you don’t miss any chances to improve your life…

Over 700 Expats in Germany said “MAYBE” without much hope at the beginning and started earning according to their needs with UberEats by completing the fleet’s registration in 5 minutes…

Lots of people took advantage of this unique opportunity, and we reached a point where there was no room for any new couriers due to low demand…

But recently, UberEats has started spending MILLIONS of euros on marketing to expand into new cities such as Ulm, Bochum, and Kaiserslautern and to consolidate their positions in major cities like Berlin, Munich, and Frankfurt.

And for a short period, there will be a few spots available for those looking for a way to earn MORE after their main job…

Or for people who want to focus entirely on entrepreneurship in a big city to escape the constraints of a regular job and live a better life in Germany.

The best part about this is that you don’t even have to say ‚YES‘, you just need to say ‚MAYBE‘:

- ‚Maybe I can earn hundreds or thousands of euros EXTRA by delivering food from the comfort of my car.‘

- ‚Maybe I can start a successful company and forget about the stress of rising prices.‘

- ‚Maybe I can join a community with over 250 weekly active couriers who work independently to ensure a better life in Germany for themselves and their families.‘

Take a second and imagine that you could be just one phone call away from turning this ‚MAYBE‘ into reality and changing your financial situation…

You just have to fill out a FREE form in 5 minutes, without even:

Paying a dime until you start earning as a courier.

Opening a company until you get all of the details you need to decide if you want that.

Any constraint or hidden commitment…

In the last few months, Uber has dropped many fleets, so many couriers are looking for a new one and the vacancies are filled very quickly.

For example, the city of Solingen was opened for couriers one day and closed the very next one…